It’s difficult for anyone to imagine what the world will be like 10 years from now, let alone two or three decades in the future. It’s also difficult, if you’re young, to imagine yourself as an older person. But aging is a predictable reality — for individual people and larger populations.

“Of the many significant forces shaping the U.S. economy — including globalization, automation, and housing supply — none is so inevitable and invisible as the sheer march of time for today’s adults. … The greying of America will touch every station of economic and political life: the size of the labor force, the jobs the economy will require, the ethnic makeup of the country, and the productivity of the workforce. In short, aging affects everything.” (The Atlantic)

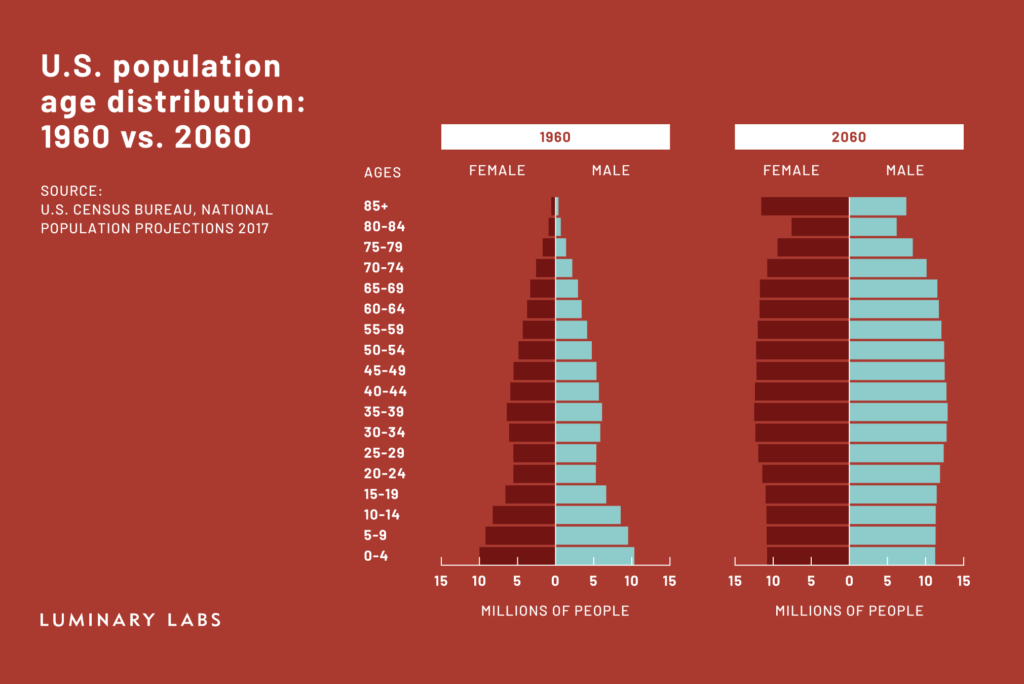

In the United States, age demographics are changing dramatically. Americans are living longer and fertility rates are dropping, resulting in a population distribution that will look more like a pillar than a pyramid by 2060. As soon as 2035, the United States will be home to more people over 65 than under 18.

How we got here

Medical advancements have increased Americans’ life expectancy. Vaccinations help people avoid disease entirely, and drug development allows people to live with chronic diseases like diabetes and, increasingly, cancer. In 1900, the average American could expect to live 47.3 years. By 2014, life expectancy reached an average 78.9 years — a number that is holding steady, though drug overdoses and suicide have slightly reduced life expectancy each year since 2015. (Life expectancy varies by gender, race, and economic status; not everyone benefits equally.)

Meanwhile, as life expectancy has increased, fertility rates have declined. Birth rates started to drop during the Great Recession and haven’t rebounded. The number of babies born in 2018 was the lowest since 1986, with record-low fertility well below the rate required for the population to replace itself. Americans are having fewer children, later — if they have them at all — partly because more would-be parents work outside the home, by choice and by necessity, and childcare can be a financial strain and logistical challenge for families.

By 2030, all Baby Boomers will be older than 65, and 20% of the population will be at retirement age. The Census Bureau projects the 2030s will be “a transformative decade for the U.S. population,” with population growth slowing down and older people outnumbering children for the first time in U.S. history.

What’s at stake

The “Longevity Economy,” championed by AARP, suggests that older Americans have a disproportionately positive effect on the economy; people over 50 are only 35% of the U.S. population, but contribute 43% of total U.S. GDP. With this in mind, many executives see demographic shifts as an opportunity to develop and sell new products and services to an aging audience of consumers. But economic factors and other trends point to larger fundamental shifts in the way we live and work — and pay the bills.

Slower population growth means slower economic growth, with “fewer people working, producing, and consuming goods, and fewer people to support a rapidly aging population.” Baby Boomers’ peak spending years have ended, and younger generations don’t have the net worth and buying power to make up for it. Pensions are underfunded, and many Baby Boomers haven’t saved enough to retire.

As the old-age dependency ratio surpasses youth dependency, some families will stretch a single generation’s income to support multiple generations. (More than half of Americans over 60 are already supporting a parent or adult child.) It’s unclear how (or if) the government will cover public-assistance costs for older Americans who can’t make ends meet and don’t have support from family members.

The idea of increasing the retirement age to 70 or older has been politically unpopular, but many seniors are already staying in the workforce longer — if they are healthy and have the requisite skills.

Since 1998, “U.S. employment has increased by 14 million for those aged 55-64, and 6 million for those aged over 65. … This increase in the number of older workers is not simply a consequence of there being more older people. The bigger change has come in behavior — a higher proportion of older individuals are now remaining in the workforce.” (Quartz)

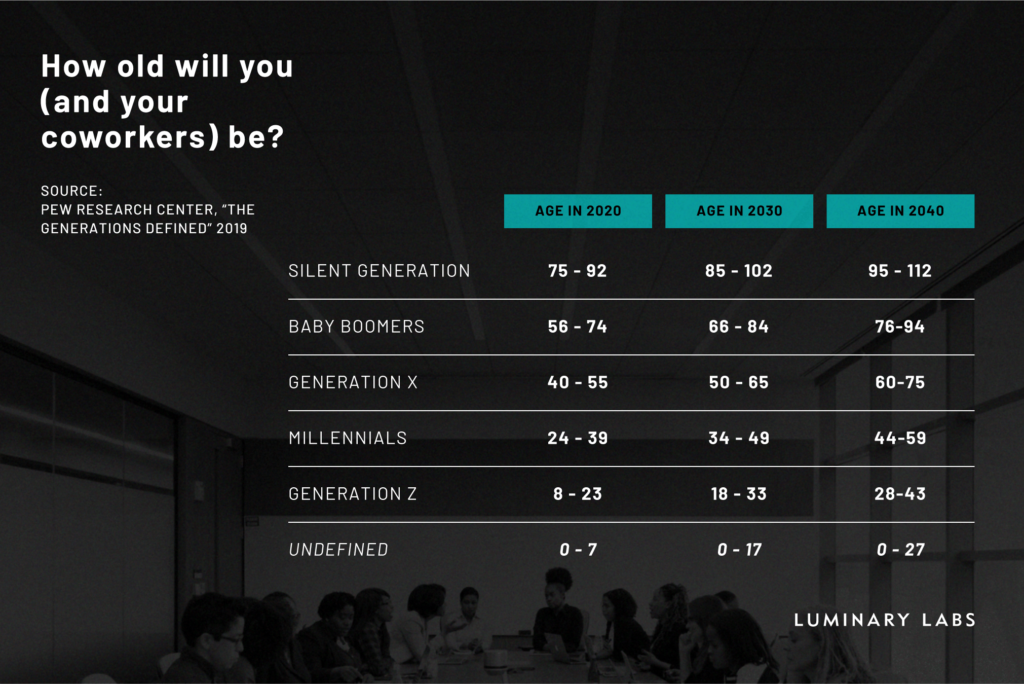

Some organizations are already employing several generations at once. By 2030, at least four generations will be working together. Managing a multigenerational workforce presents cultural and pragmatic challenges; upskilling, reskilling, and lifelong learning will be even more important as workplaces shift from seniority-based to skills-based employment.

While older workers have fewer workplace accidents than younger workers (experience matters), their accidents tend to be more severe and result in longer recovery periods. Currently, the law requires employers with more than 20 employees to offer older employees the right to receive the same benefits as those under 65. Will businesses be able to absorb the increased healthcare costs for an aging workforce, or will regulations change? Or will older workers be relegated to “the gig economy” as soon as they’re eligible for Medicare?

Aging in and of itself becomes a healthcare question; what we treat, how we treat, and who treats it will change. Demand for healthcare goods and services is expected to double by 2025 compared with 2015 levels. At the same time, the growing in-home care industry is facing a worker shortage, and unpaid caregivers are also aging.

“Today, an estimated 34.2 million people provide unpaid care to those 50 and older. These caregivers, about 95% family, and long the backbone of the nation’s long-term care system, provide an estimated $500 billion worth of free care annually — three times Medicaid’s professional long-term care spending … But the supply of these caregivers is shrinking just as the nation needs them most. … the ratio of caregivers to care recipients peaked in 2010 and has been falling since, in large part because of changing family dynamics.” (Wall Street Journal)

It’s possible, but rare, to age in good health, and researchers striving to increase longevity are, in effect, treating age as a disease to be reversed. As lifespans increase, we expect to see more instances of age-related disease states and comorbidities that strike later in life.

Baby Boomers are aging alone more than any other generation in U.S. history, and loneliness is an acute problem among older populations. Researchers say a lack of social connection and feelings of isolation can be as damaging as smoking 15 cigarettes a day and is a risk factor for other diseases, including Alzheimer’s, stroke, and obesity. The health impacts of loneliness add up: an AARP study found a lack of social contacts among older adults is associated with an estimated $6.7 billion in additional Medicare spending each year.

Togetherness may be one of the factors behind an increasing demand for multigenerational homes, but the financial realities of retirement and access to care also motivate extended families to live together. More than 4 in 10 homebuyers say they’re considering space for an elderly parent or adult child.

Potential solutions

Many innovators are focused on extending longevity, but we’re particularly interested in novel approaches that enhance quality of life across age groups. In some cases, organizations are tackling a number of issues at once: Aging 2.0, a community of innovators with local chapters around the world, encourages partnership and collaboration around eight major challenges — from financial wellness to care coordination. Other innovators are focused on solving specific problems. We’re tracking a number of new models, collaborations, services, and other ideas that address several key areas.

Health and well-being

Healthcare is one of the greatest challenges facing aging Americans. Seniors need access to care and support, and the organizations serving them should think holistically about the systems and social factors that contribute to better health.

- Lowering costs and improving outcomes. Startups and incumbents are investing in care offerings specifically geared toward seniors; many are looking toward technology and home health services to better meet patient needs. Caremore, an Anthem subsidiary serving Medicare and Medicaid patients, has pioneered a clinical approach to loneliness that demonstrates positive outcomes.

- Managing the logistics of medical care. Dispatch Health lets patients request in-home medical care via app. Meanwhile, ridesharing apps have developed special options like Uber Health and Lyft Concierge for transporting seniors to medical appointments.

- Social connection. Though social media and other forms of technology can have a negative impact on mental health and relationships, one study found that higher levels of internet use are significant predictors of reduced loneliness and better psychological well-being among older adults. In the U.K., the Silver Line provides empathetic support to isolated seniors via phone.

Aging in place

In the 20th century, homes and communities were designed around individuals and nuclear family units. Changing demographics and economic pressures are revitalizing interest in an age-old way of living — as part of an age-diverse community.

- Livable neighborhoods. AARP is developing a network of age-friendly states and communities that are livable for people across age groups, with “walkable streets, housing and transportation options, access to key services, and opportunities for residents to participate in community activities.” More thoughtful urban design can counter loneliness, and some cities are experimenting with building kindergartens or preschools next to nursing homes, where children can meet with elders for storytime and other activities. Generations United, a policy group, advocates for intergenerational community programs and multigenerational living.

- Cohousing and multigenerational homes. Homebuilders such as Lennar are actively marketing multigenerational home models to address shifting needs of families. PDX Commons is one of 170 cohousing communities in the United States; advocates want to build hundreds more. Silvernest is a roommate finder service for empty nesters who own their homes and want to rent out unused space to housemates; Nesterly is similar, and focuses on matching older people with students looking for a place to stay. Many local solutions are popping up to connect potential roommates, in an effort to address the overlapping issues of loneliness and housing affordability.

- Safety and monitoring. Connected technologies, including wearables and smart home devices, can provide peace of mind (and data) to aging Americans and caregivers. Pill dispensers and fall detectors are designed with older users in mind, and voice-enabled devices like Amazon Alexa and Google Home can be used to help seniors live more independently. (As with any services that collect location and health data, privacy and other tradeoffs are considerations.)

- Accessible products and services. Inclusive design that’s usable for people with varying abilities can be aesthetically pleasing while accommodating the physical realities of aging bodies. MIT’s AgeLab incubates new ideas and technologies that improve health and daily life for older people and those who care for them. New York State’s Aging Innovation Challenge, an open innovation competition, asked college students to design solutions to improve quality of life for seniors and their caregivers.

Work and labor

Older workers will need to adapt to modern workplaces, and their employers will need to support intergenerational collaboration or find new models for employment.

- Championing age diversity. Conversations about diversity and inclusion should expand to encompass age diversity. Only 8% of global companies with diversity and inclusion teams have strategies for increasing age diversity. Some companies have internal groups to support older employees: Google’s “employees of a certain age” are called Greyglers, and UberSages provide “a safe space for Uber employees 40+.”

- Intergenerational collaboration. Two-way mentoring — also called reverse or reciprocal mentoring — can promote knowledge sharing and collaboration on age-diverse teams. Older employees can share hard-earned experience and problem-solving skills; younger employees can provide new perspectives and introduce new technology skills.

- Attracting and retaining older employees. CVS retains older workers through its “snowbird” program: pharmacists and other employees can work in northern stores in the summer, then transfer to stores in warmer climates during the winter. McDonald’s is partnering with AARP to attract older workers, starting with a pilot program in selected states before rolling out a national program to hire 250,000 people.

- Phased retirement and flexible work options. Only one in five companies offer some type of phased retirement program, even though almost half of employees say they want to transition into retirement with reduced hours or different roles. In its engineering department, Pitney Bowes offers phased retirement and flexible work options to increase engagement and support knowledge transfer. (That’s just one of many case studies in the innovative practices database maintained by the Center on Aging and Work at Boston College.)

- Post-retirement careers are not uncommon. The Center for an Urban Future sees a trend toward “encore entrepreneurship” in New York City, where nearly 210,000 self-employed residents are 50 and older, up 19% since 2005.

Finance and policy

Financial wellness can have an enormous impact on quality of life in any age bracket. Will Baby Boomers who have accumulated wealth be able to transfer it to younger generations, or will their savings be used to pay for healthcare and student debt? How can Americans build wealth in the present and manage it effectively in the future?

- Rethinking retirement savings and income. Proposed changes to federal rules and pressure from fintech startups may open up new, higher-value ways for people to manage their finances and create lifetime income streams.

- Leveraging home equity. Startups and investment companies, including Equifi and Point, are helping older Americans who own their homes access equity through co-investment, reverse mortgages, and other financial products.

- Reducing debt and building intergenerational wealth. Debt can cancel wealth accumulation and intergenerational wealth transfer. Policies that expand access to healthcare and reduce student debt could help Americans save more for retirement while ensuring younger generations also receive support as they age.

Are you studying this problem or working on a solution? We’d love to hear your thoughts — send a message to editor@luminary-labs.com.