Once a year, executives earn a second job: annual planning. At a minimum, it is an exercise in right-sizing budgets to achieve organizational goals. But when symbolic years loom, organizations shift the goal posts, prompting new questions. What does the business need to achieve by 2030? And what factors are most likely to help or hinder progress?

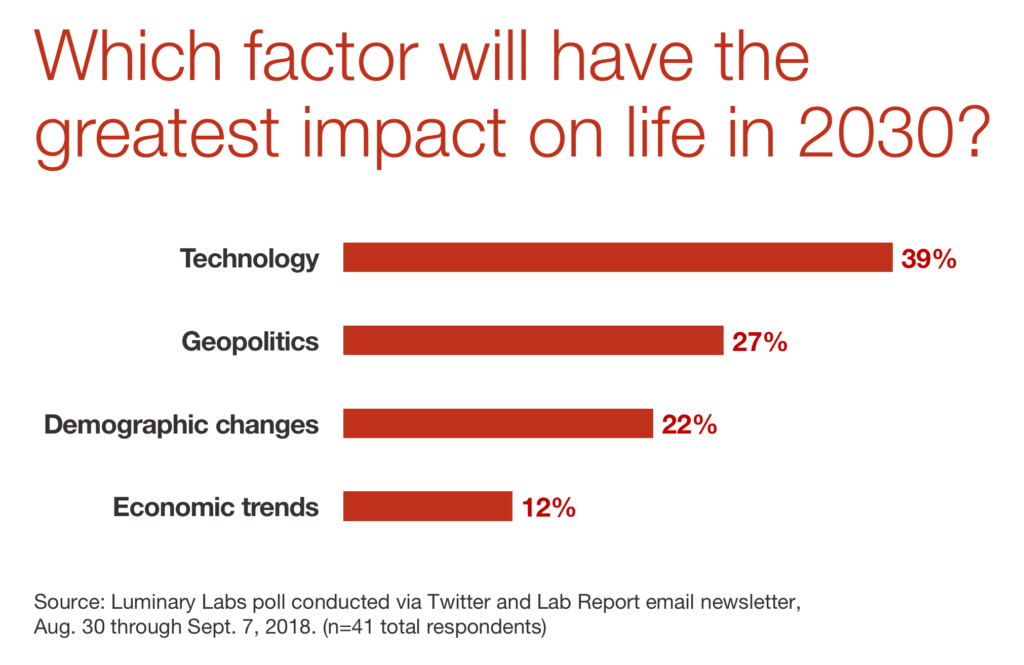

We recently asked Lab Report readers and Luminary Labs Twitter followers to weigh in on an opinion poll: “which factor will have the greatest impact on life in 2030?” Perhaps not surprisingly, “technology” received the most votes, but we heard from readers who said they struggled to choose just one factor.

To be fair, no one knows the future. The most hyped technologies often flop (remember the Segway?) and the technologies that have the greatest impact can be a complete surprise. Geopolitics are increasingly unpredictable as the poles of power are shifting. The next recession is likely to happen soon; we just don’t know when.

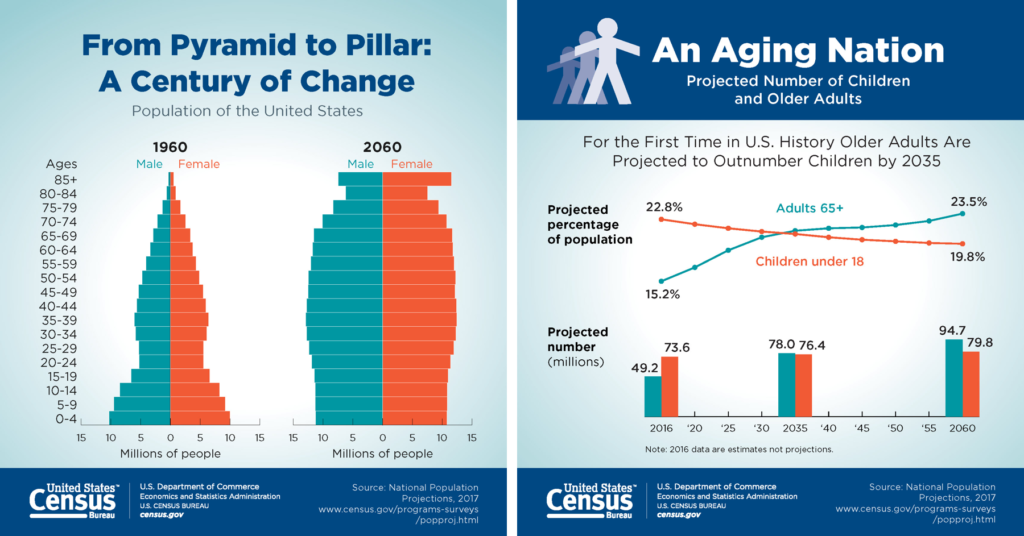

But there is one factor that we can be sure of: demographic changes. Americans are living longer and fertility rates are dropping, resulting in a population distribution that will look more like a pillar than a pyramid by 2060. As soon as 2035, the United States will be home to more people over 65 than under 18. The racial makeup of America will also shift, and the biracial and multiracial population is projected to be the fastest-growing over the next several decades.

The graying of America is not new. Open any news site and you will read about how 60 is the new 40. While some might see this as a business opportunity in the short term, organizations will need to plan for the long-term economic and political effects.

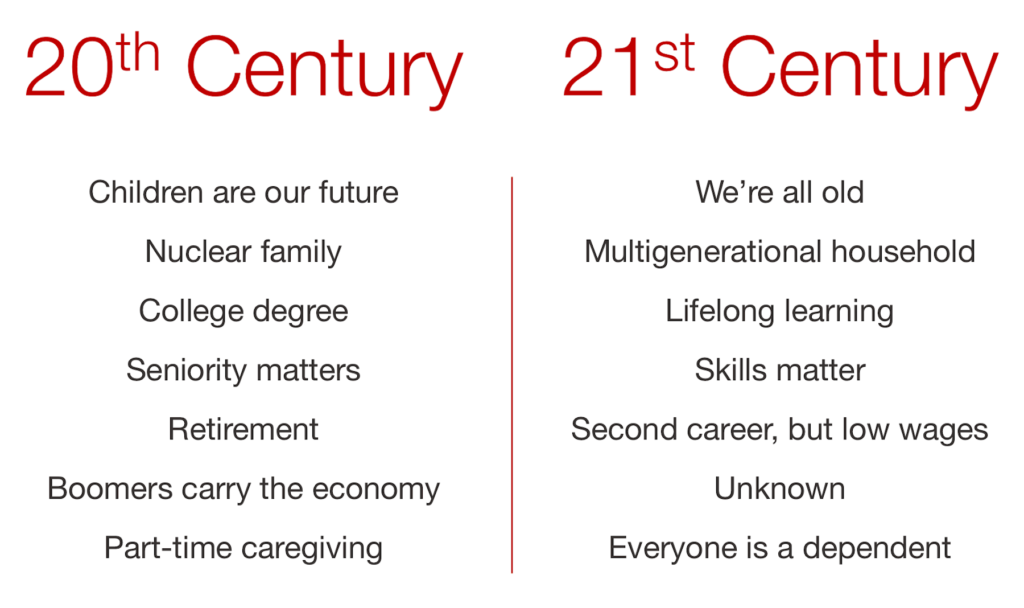

- Americans will be working longer. Living longer means that retirees will have second careers — if they are healthy. Some will work because they want to; others will work longer because they have to. Among households with members aged 55 or older, nearly 29% have neither retirement savings nor a traditional pension plan. Contributing to the inability to save is a lack of increase in wages as well as student loans and other debt.

- Multigenerational workforces. Forget the Millennial workforce debates. By 2030, four generations will be working alongside each other. The managerial considerations of multigenerational workforce are both cultural and pragmatic as we move from seniority-based to skills-based employment and a lifelong learning model. Adult education and upskilling will be more important than ever.

- Automation will keep wages low. Wage growth has been stagnant for decades. While many fear the loss of jobs to automation, it is low wages that should cause real concern. In previous industrial revolutions of the 19th and 20th centuries, wage recovery took decades. As the fourth industrial revolution coincides with shifting workforce demographics, we may continue to see more jobs, but at lower wages.

- Health and benefits. With an aging workforce, we anticipate that there will be more comorbidities. And while older workers have fewer workplace accidents than younger workers (experience matters), their accidents tend to be more severe and result in longer recovery periods. Currently, the law requires employers with more than 20 employees to offer older employees the right to receive the same benefits as those under 65. Will businesses be able to absorb the increased costs of healthcare for an aging workforce, or will regulations change? Or will older workers be relegated to “the gig economy” as soon as they’re eligible for Medicare?

- Baby Boomer spending will dip. Following a peak in 2020, Baby Boomer spending will start to fall off. Given the size of this generational cohort and its historical affluence — Boomers had the conditions to save — its spending patterns have had an outsized impact on the economy. Organizations large and small will no longer be able to count on Boomers, and will need to identify new segments that may or may not have the same spending power.

- Who will become a dependent? As the 65+ population grows, the old-age dependency ratio is projected to surpass the youth dependency ratio around 2033. Falling fertility rates will support this trend; going forward, America will have more old-age dependents than youth dependents, creating key questions around policy, tax exemptions, and household disposable income.

- The multigenerational home. A record 64 million Americans currently live in multigenerational households; those with two adult generations (parents and their adult children over 25) are the most common type. Homebuilders such as Lennar are actively marketing multigenerational home models to address shifting logistic and financial needs. The net economic impact of this shift is unknown. While incomes may need to stretch across multiple family members, families might find savings in shared expenses or childcare.

If any part of your job is focused on the future, you’ll need to consider the future of technology. But you’ll need to spend as much time — if not more — on the future of humans. Real human needs will dictate where and how technology is deployed, not the other way around.

Photo by Pixabay on Pexels